gst cash payout 2022

Disbursed in 2023 and 2024. GST Securities Transaction Tax STT SEBI turnover charges.

Star Health and Allied Insurance and Niva Bupa Health Insurance having registration no.

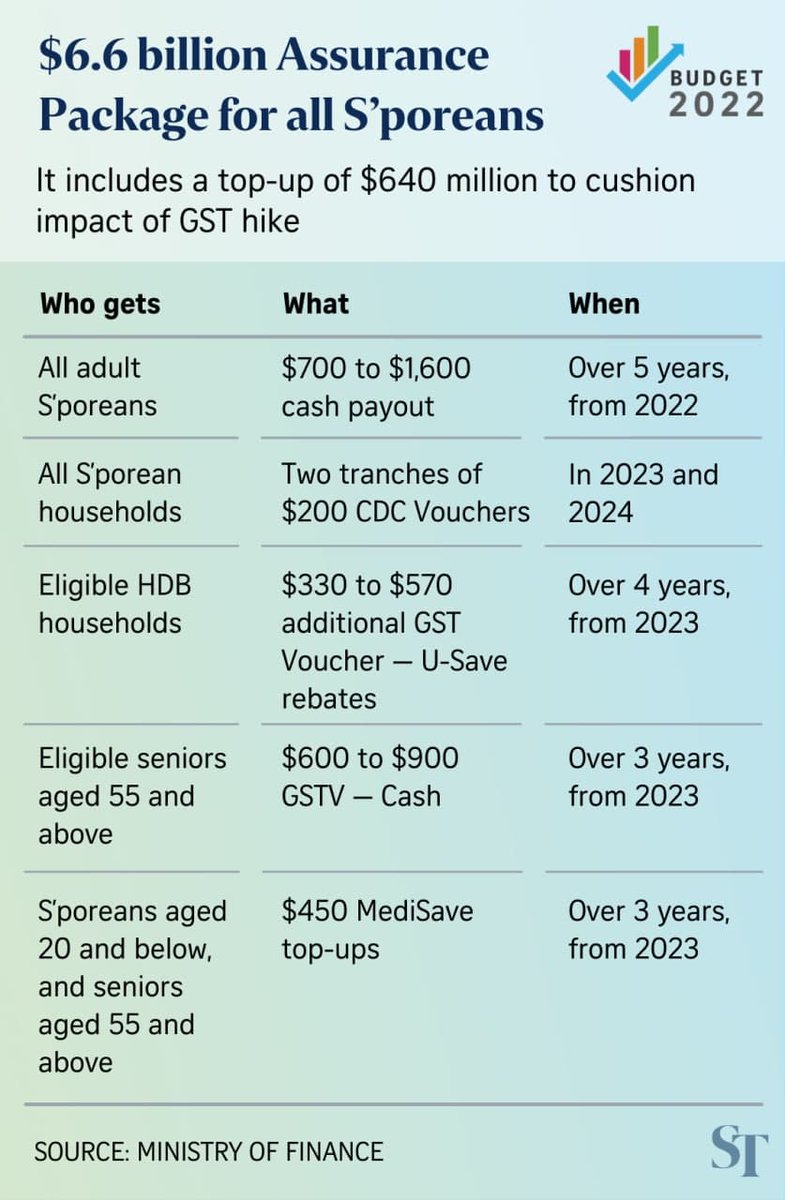

. Sole-proprietors who are filing their own GST returns can refer to this two-page instruction 502KB. For 2021 households that receive the GST Voucher U-Save will also receive a GST Voucher U-Save Special Payment. Four years from 2023.

Five years from 2022. CA0113 valid till 31-Mar-2022. The minimum brokerage for.

Taking twice of the second cash payout would be equivalent to 1-month contracted gross rent as indicated in the stamped lease agreement for the period 22 Jul 2021 to 18 Aug 2021. This was paid out in April 2021 and July 2021. For a step-by-step instruction on authorising users Preparer or Approver role for GST filing please refer to the following guides depending on.

S330 to S570 additional GST Voucher GSTV U-Save rebates. All Systematic Equity Plan transactions would attract brokerage equivalent to Cash segment. S700 to S1600 cash payout.

The GST Voucher U-Save will be paid out in April 2021 July 2021 October 2021 and January 2022. Directors or partners who are filing the GST return for their own businesses can refer to this two-page instruction 449KB. The third cash payout will be distributed automatically to all recipients of the second cash payout to ensure that eligible tenants and owner-occupiers receive their payout as quickly as possible.

When Will I Get My GST Voucher U-Save Special Payment. Two tranches of S200 Community Development Council CDC Vouchers.

Budget 2022 S Poreans Aged 21 And Above To Get S 700 To S 1 600 Cash Payout Over Next 5 Years News Wwc